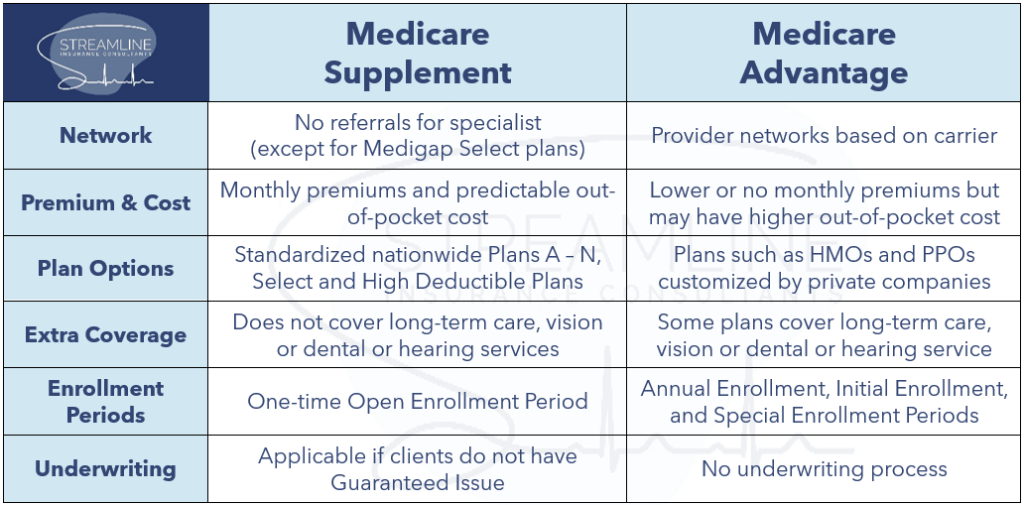

- In order to enroll into a Medicare Supplement or Medicare Advantage plan you must be enrolled in Medicare Part A & B and live in the state where the plan is offered

- Plans and prices may vary based on state or even county

Medicare Supplement

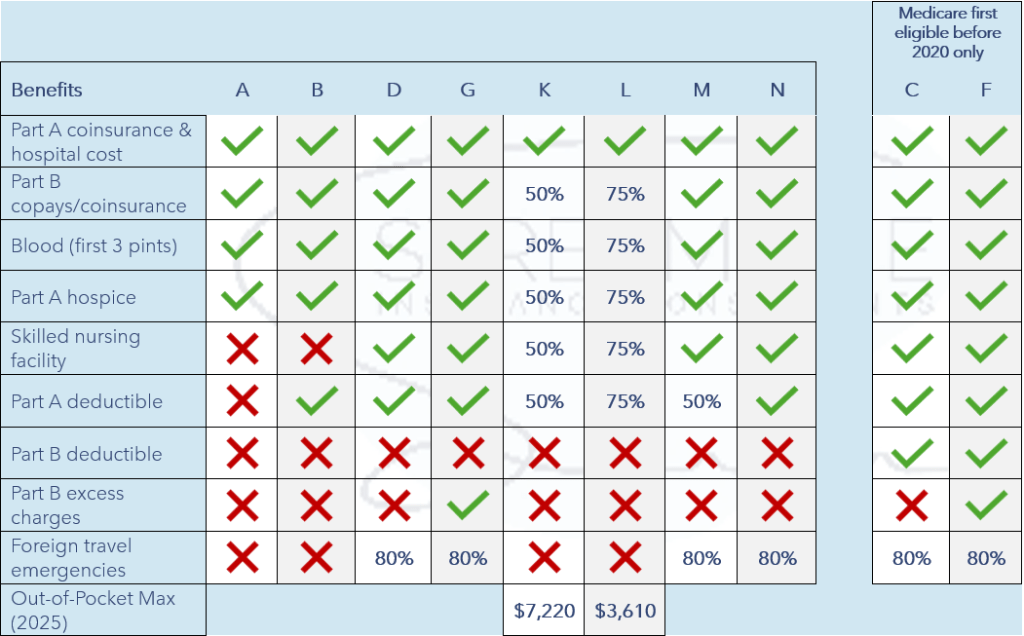

- Plans are labeled A – N which are regulated by Medicare and will not differ from carrier to carrier. The only difference between carriers are the monthly premiums. Some carriers will also offer age locks and let you switch letter plans without medical underwriting.

- Age Lock: Monthly premium that lock you in at the age you entered the medicare supplement

- i.e you signed up for a supplement at 65, but are now 78. with an age lock you will still be paying the rate for age 65 instead of age 78.

- Age Lock: Monthly premium that lock you in at the age you entered the medicare supplement

- Considered a 3-payer system. The first payer is Medicare (Medicare Card), second payer is the supplement and third payer would be your stand-alone part D plan (prescription drug plan)

Benefits of a Supplement

- You can go to any Doctor, any specialist, any facility that accepts Original Medicare

- Anderson Cancer Center

- Memorial Sloan Kettering Cancer Center

- Mayo Clinic

- Cleveland Clinic

- No Prior authorizations, as long as your provider states the service (Medical test, procedure, operation, etc.) is medically necessary you can get treatment

- No Medical underwriting during initial enrollment into Original Medicare (age 65), and guaranteed renewable once you have a supplement.

- The only reason the policy can be cancelled is for non-payment of premium.

- Policy is completely portable and will travel with you even if you move!

- Stand-alone drug plan is required.

- Shop all plan in market during open enrollment to find best plan based on prescriptions taken.

2025 Numbers:

Part A Deductible: $1,676.00

Part B Deductible: $257.00

Foreign Travel Deductible: $250.00

Excess Charges: 15% above the Medicare allowable

Medicare Advantage

- Managed care available if needed

- Cheaper monthly Premiums (with out-of-pocket max as a stop-loss)

- Additional perks (Ancillary benefits) included in the plan

- Dental & vision coverage

- Hearing aid benefits

- Flex cards to put towards OTC medications, groceries, utilities & more

- Gym Memberships

- Home meal delivery following inpatient stay

- One Payer System! Part D is included in Medicare Advantage plans

- Some plans may rebate Part B Premium!

Low Monthly Cost

- No or low premiums depending on the state you are in (FL has $0 premiums)

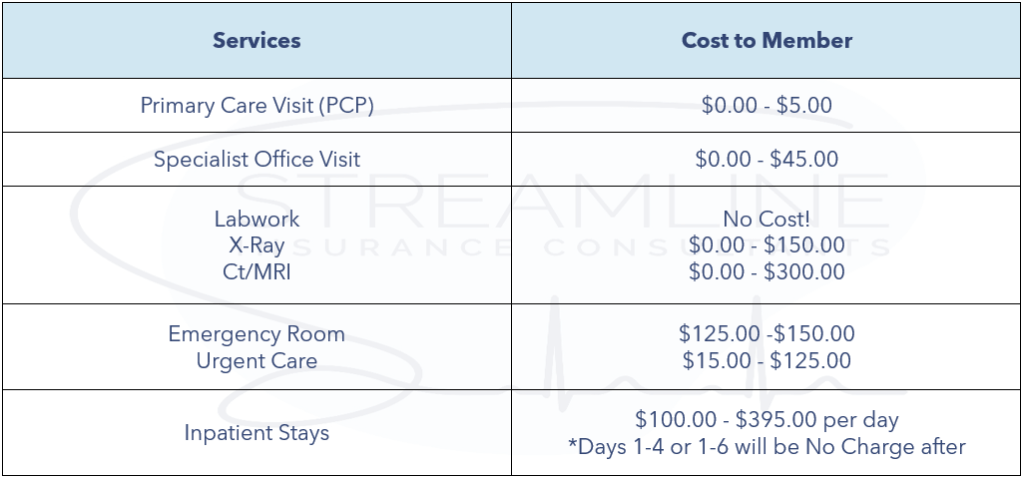

- You only pay when you use the service!

- $0.00 deductible!

Advantage Plans w/ Part D Coverage

- Prescription drug plans may have a $0.00 – $590.00 deductible for higher tiered prescriptions depending on the plan.

- Many copays are lower

- Drug Formulary’s are designed with lower tiers

- i.e Same Rx on Medicare Advantage plan may be a tier 1 or 2 medication while on a supplement it would be a tier 3

- Mail Order plans available with up to a 100-day supply

Networks

- Medicare Advantage plans rely on networks

- PPO Plan

- Offers In and Out-of-network coverage

- Can travel across state lines

- Higher out-of-pocket max compared to HMO

- HMO

- You can only go to in-network providers. No coverage for out-of-network services

- Usually, a smaller network and may requires a referral from Primary Care Provider

- Lower out-of-pocket max

- PPO Plan

- Some big-name Hospital systems will NOT be included

- Anderson Cancer Center

- Memorial Sloan Kettering Cancer Center

- Mayo Clinic

- Cleveland Clinic