Each year Medicare Part A & B insurance premiums, as well as the deductibles generally increase annually due to inflation. This year, is no different. Medicare regulates these changes and they will be consistent across the board. Then in addition to your Medicare Part A & B, you may be seeing additional increases to your Medicare Part D (Drugs) and Medicare supplement/advantage policies. Today we are going to focus on Medicare Part A, B & some generalized information about Part D.

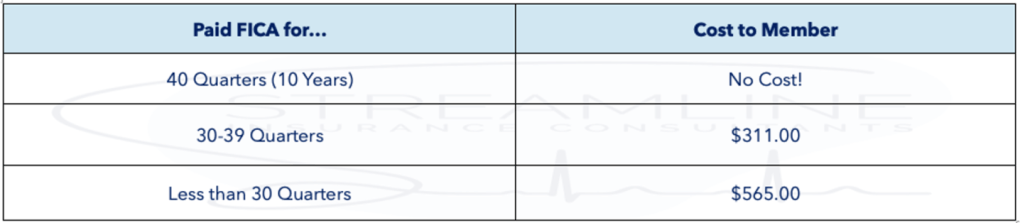

To start off we will discuss Medicare Part A (Hospital). Generally speaking, Part A does not usually cost anything as long as you have worked 40 quarters or 10 years, paying into FICA. As long as you did that, you will pay $0 for your Medicare Part A. Then if you worked less than 10 years, and did not pay into FICA, there may be some cost to Medicare part A. I have added the chart below to show the cost of Medicare Part A if you did not work 10 years.

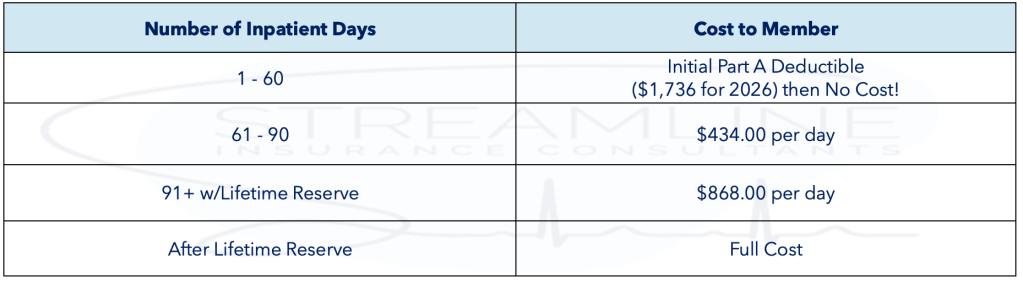

Another part to consider, is what original medicare would cost you if you did not have a Medicare supplement or Medicare advantage plan. On original Medicare, if you do not have a supplemental plan and you were admitted to the hospital, you would need to meet the Part A deductible every 60 days. This deductible in 2026 is $1,736. In the first 60 days of your stay you would need to meet the deductible, and then everything is no cost. Then if you were to be hospitalized longer, days 61-90 would cost $311 per day, then if you made it to day 91-365 and still had a lifetime reserve, then you would spend $868 per day with no out-of-pocket max.

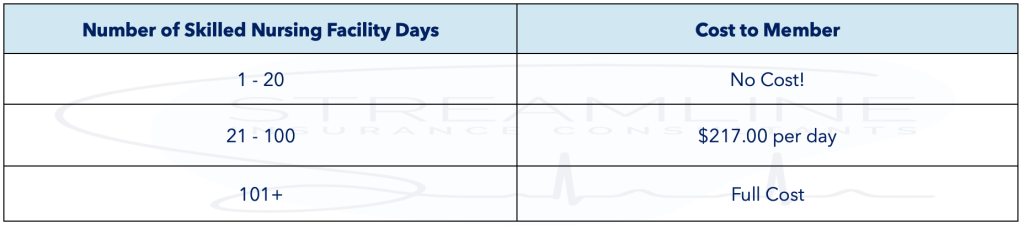

Then, after a hospital admission sometimes you are sent to a skilled nursing facility (SNF) for rehab before you can be discharged home. Medicare Part A would cover days 1-20 at no cost! Then if you had to be admitted for rehab longer, days 21-100 your cost would be $217 per day until day 101+ at which time you would be responsible for all cost. Both inpatient stays and SNF’s are covered as long as the stay is medically necessary and the facility accepts original medicare. These prices have increased slightly from 2025, but if you have a Medicare supplement or advantage plan you may not pay these prices, as your cost is subject to the plan.

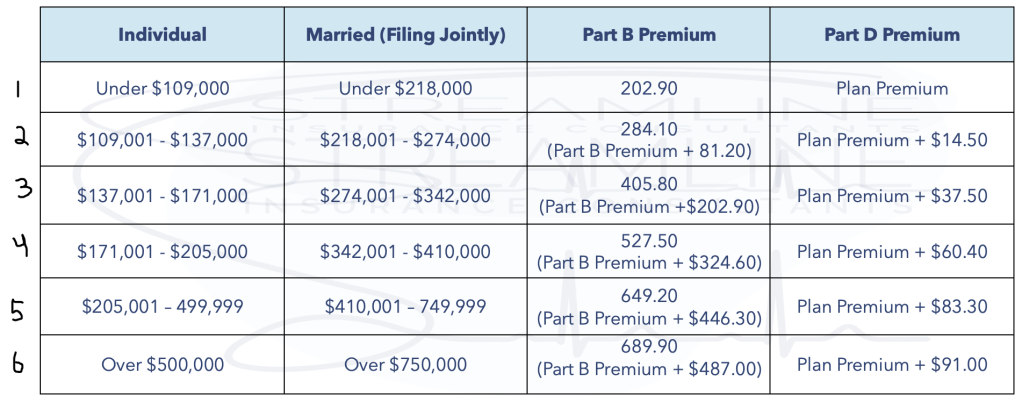

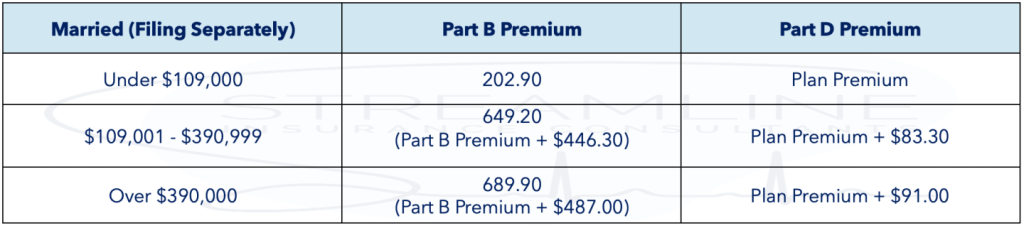

Next, we will talk about your Part B (medical) premium and the IRMAA chart. IRMAA does a 2 year look back. So, in 2026 Medicare will look at your income from 2024. The best benefits will always come from those filing single – filing individually & married – filing jointly. There are harsher guidelines if you are Married – filing individually. To only pay the base premium of $202.90 (Previously $185) you will need to be single or married (individual) making under $109,000 per year, or Married (jointly) making under $218,000 per year. If you were to be in a higher bracket in 2024, but in 2026 you will be uinder the base premium bracket, please let a Streamline Insurance Consultant Broker know or your local agent so they can help you get an SSA-44 form to file to your local social security office to help decrease your monthly IRMAA payment.

If you are in one of the higher brackets, you will notice you will have an extra charge for both your Part B and Part D premium. So for example, if you made $386,000 per year in 2024 and you were still making that amount in 2026 filing married (jointly), you would be in the 4th bracket which would make your Part B premium $649.20 (base premium of $202.90 + IRMAA penalty $324.60) and then in addition to that you would also need to pay $60.40 to your Part D carrier in addition to your part D premium. So if your Carrier charges $25.90, then you would be paying $86.30 per month until your income lowers.

Lastly, we will discuss the Medicare Part D (Drugs). Part D plans are offered through carriers like Aetna, BlueCross BlueShield, Cigna (now Health Spring), Humana, & United Healthcare. These carriers will offer different plans with varying monthly premiums & formularies, but the one thing that must be consistent across all plans is the Prescription Out-of-Pocket max, which for 2026 is $2,100. In 2025 Medicare did away with the donut hole, and added a Prescription Drug Out-of-Pocket (OOP), so in 2026 the OOP increased by $100 from the previous year. The idea of the OOP max is to put a cap on spending and protect you from spending too much. Another thing that Medicare changed from 2025 to 2026 is they increased the prescription Max Deductible from $590 to $615. So, in 2026 the most a plan can set your deductible at is $615, which is usually for higher tiered medications only (tiers 3-6). This will be the amount of money you must spend, before the plan starts to pay a portion. So for example, Eliquis is normally a tier 3 medication that cost about $250 for a 1-month supply in 2026. If you had a plan with a $615 deductible then you would need to pay $250 for 2 months, then the 3rd month you would pay about $115 to meet the deductible. Then after that portion you would go into initial coverage where your medication is may $65 for a 1-month supply, and you would pay that amount until the end of the year when your plan resets OR until you reach the $2,100 OOP max. Once you meet the OOP then you will pay nothing.

If you want to learn more about the Medicare Premium changes or want more information make sure you contact us at Streamline Insurance Consultants or an experienced local agent/broker for this journey. If you are new to Streamline Insurance Consultants, please visit our Contact Us page and fill out the form so we can get in touch with you and help you through these confusing changes!

Leave a comment