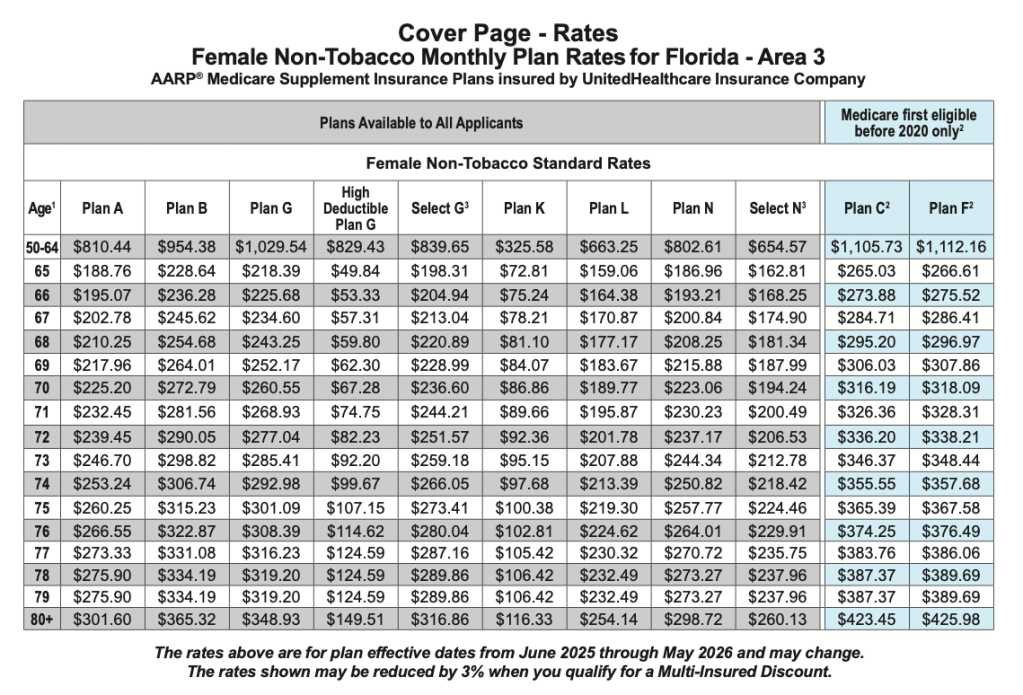

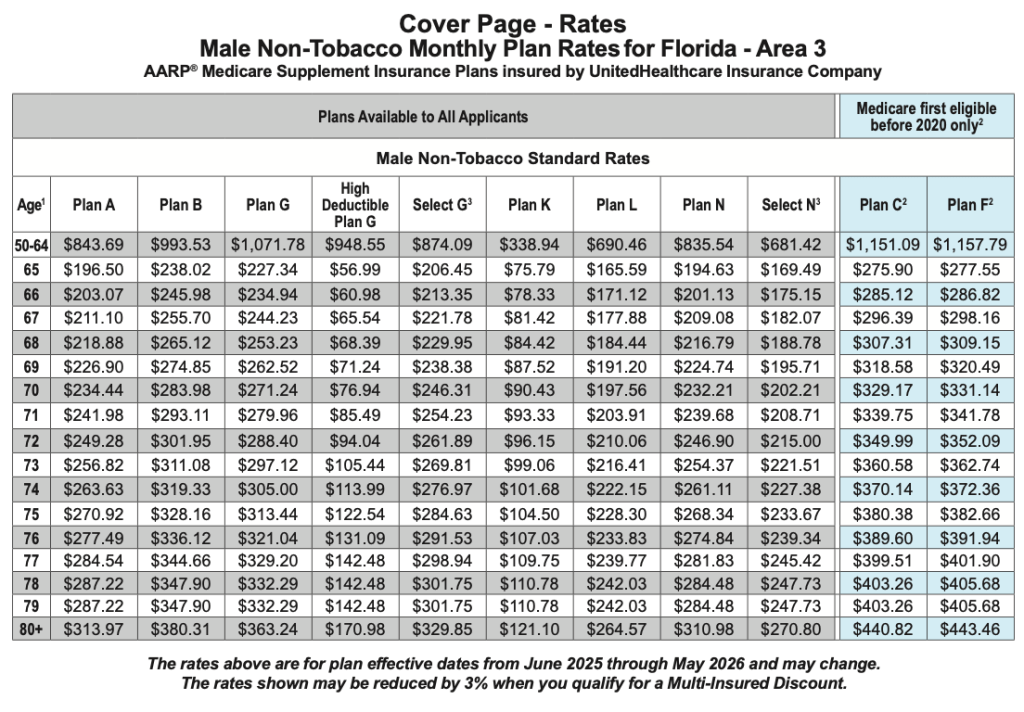

Medicare Supplement insurance premiums generally increase annually due to several factors, including inflation, rising healthcare costs, and the age-attained pricing method used by many companies. Additionally, Medicare itself often increases deductibles, which can also lead to premium increases as supplement plans cover those deductibles. This year United Healthcare has announced that their monthly premiums will be increasing by an average of 18% across the several supplements plans they offer. For example, the Supplement G plan for a 65-year-old women, non-tobacco smoker in area 3 would have paid $196.24, but starting June 1st will now pay $218.39.

So, what truly goes into the increased rates for the supplement plans? One contributing factor is the rising healthcare cost and inflation. The cost of healthcare continues to increase which in turn causes insurance companies to pay more when they cover individuals. This means they will need to increase the monthly premiums to bring in more money to support the money going out when they pay claims. Not everyone that has insurance uses their insurance, so those who don’t use their insurance will have their premiums pulled to pay for other people’s claims. Another way insurance companies will make money to pay your claims is by investing the income in stocks, bonds and real estate to generate additional income. These investments will allow them to not only rely on the premiums coming into the company. Therefore, the increasing rates are a key driver for annual premium increases.

Another contributing factor is age-attained pricing. United Healthcare, like many other Medicare Supplement plans age-attained pricing, which means your premiums are based on your age when the policy is obtained. The premiums prices are much cheaper at age 65 compared to age 74. For example, the Supplement G plan for women, non-tobacco smoker in area 3 would $218.39 at age 65, but then would be $292.98 at age 74 (2025). The locked in age-attained pricing is a contributing factor because someone obtaining coverage at 65 are more likely to keep the coverage longer than someone who is 74, and in general, as you age, you will utilize your healthcare more. While it possible to be healthy your whole life, many may see advances in illness as they age.

The next contributing factor is the increases to the Medicare deductible. Medicare deductibles often increase annually, and some Medicare supplement plans cover those deductibles. In 2025 the Medicare deductible increased by $17 going from $240 in 2024 to $257 in 2025. While this may not seem like a large jump, the Medicare supplement plans will need to make up for the difference for everyone on a plan that covers the Medicare deductible (Plans C & F). If there are 100 people on a plan that covers the Medicare deductible, then the supplement plan will need to make up for the $1,700 difference for each member. So, as the Medicare deductible rises, the cost for the supplement plan to cover that deductible also increases, potentially leading to a premium increase.

Lastly, a contributing factor is the loss ratio adjustments. Insurance companies track something called the loss ratio, which is formula to calculate the losses through paid claims vs. how much they are taking in through monthly premiums. The formula for the loss ratio is (Incurred Losses/Earned Premiums) x 100. So, if the plan Paid out $1,000,000 in claims, but collected $2,000,000 in premiums then they would have had a 50% loss ratio. If a company’s loss ratio exceeds a certain threshold, they may need to increase premiums to maintain financial balance.

If you want to learn more about the United HealthCare plans offered in your area, or want more information make sure you contact us at Streamline Insurance Consultants or an experienced local agent/broker for this journey. If you are new to Streamline Insurance Consultants, please visit our Contact Us page and fill out the form so we can get in touch with you and help you through these confusing changes!

If you would like a copy of the new supplement book for 2025 please let us know!

Leave a comment