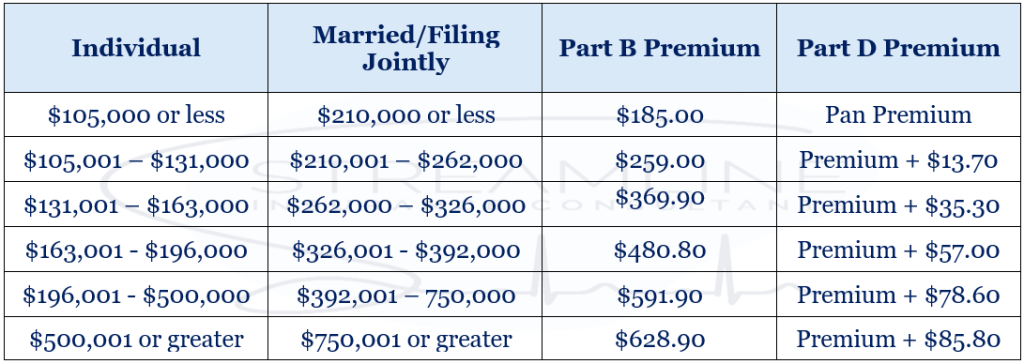

The projections for 2025’s income-related monthly adjustment amount (IRMAA) are out. IRMAA is what decides your Medicare Part B premium. IRMAA is calculated on a sliding scale with five income brackets, with the bracket topping out at $500,000 for Single and $750,000 for Married/filing jointly. These figures will change annually to account for inflation. IRMAA calculations have a two-year look-back. So for plan year 2025, you will be looking at your gross adjusted income from your tax return in 2023 (two years ago).

The 2025 amounts discussed below are an estimated based on next year’s threshold, if inflation remains constant. According to the Trustees of Medicare, IRMAA will increase to:

If your gross adjusted income for 2023 is more than what you made in 2024 or projected to make in 2025 please reach out to us or your local agent/broker to see how they can help. For example, if you made $125,000 as an single individual in 2023, but then retired in 2024 and your income dropped to $85,000, reach out! We have a form that you can fill out and mail to the Social Security office to help adjust your Part B premium since your income dropped a bracket.

Leave a comment