In 2023, the federal government spent $832 billion on Medicare, which is 3.1% of the GDP. This makes Medicare the second largest program in the federal budget, after Social Security, and accounts for 21% of national health spending. As the population ages and healthcare costs increase, the Congressional Budget Office projects that Medicare spending will increase to 4.2% of GDP in 2034.

Medicare is funded by two trust funds and a variety of sources. These include Hospital Insurance (HI) trust funds, Supplementary Medical Insurance (SMI) trust funds & Medicare Part D Premiums. The HI trust fund finances Medicare Part A, which includes inpatient hospitals, skilled nursing facility, and home health services. These funds are subsidized primarily from the income tax paid by employees, employers and the self-employed. Additional funding can come from income taxes paid on social security benefits, interest earned from trust fund investment, and Medicare Part A premiums (Only those who did not pay FICA for 10+ years).

Next, we will look at SMI trust fund which is used to finance Medicare Part B & part D benefits, as well as Medicare Program Administration that completes tasks such as paying benefits and fighting fraud & abuse in Medicare. This SMI trust fund’s main source of income is through the federal government’s general fund, which includes receipts from individual and corporate income taxes, excise taxes, and borrowing. The trust fund also receives premiums from participants, with higher premiums for higher-income beneficiaries.

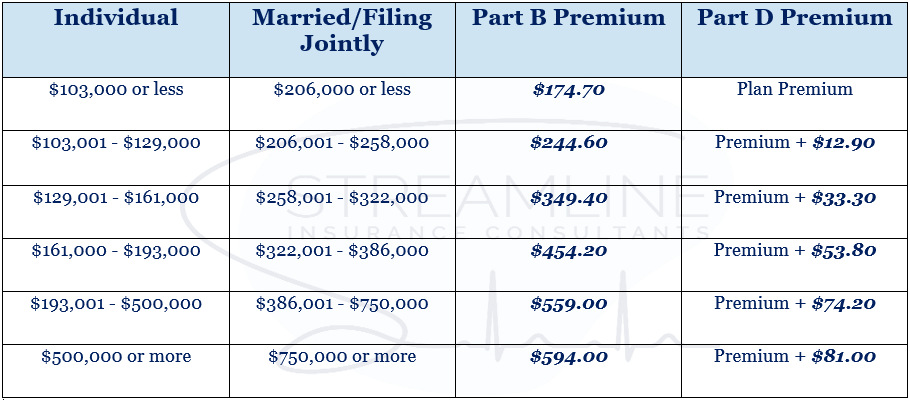

Lastly, are the Medicare Part D premiums which are also used to fund Medicare. These funds are influenced by IRMAA or Income Related Monthly Adjustment Amounts. IRMAA is used to determine your Medicare Part A and Part D premiums. The higher your income, the higher the premium you will pay. Currently the lowest Medicare Part B premium for 2024 is $174.70, which is available for those who file jointly & make less than $206,000 a year OR those filing as single and make less than $103,000 a year. Anyone with higher income (Even by 1 penny) will pay a higher Medicare premium.

Overall, Medicare Revenues Come from different sources, primarily general revenues, payroll taxes, and premiums paid by beneficiaries. If you have any questions regarding your IRMAA bracket and how that will affect your Medicare Part B & Part D premium, please feel free to contact us to discuss your options and see if there is a way we can get you to that lower bracket! Either send us an email or fill out the information on the Contact Us page for an appointment!

Leave a comment